In the quick developing scene of monetary warning administrations, the reconciliation of Computerized reasoning (Artificial Intelligence) remains as an extraordinary power, reshaping how financial backers get exhortation and decide. This article digs into the complexities of computer based intelligence in monetary warning, investigating the sensitive harmony among robotization and customized guidance that is principal for conveying ideal worth to financial backers.

The Ascent of man-made Artificial Intelligence in Monetary Warning:

As mechanical headways keep on reforming the monetary business, man-made intelligence has tracked down a huge traction in the domain of warning administrations. Robo-counselors and man-made intelligence driven calculations are progressively becoming basic apparatuses for computerizing undertakings like portfolio the board, risk evaluation, and monetary preparation.

Robotization’s Productivity and Difficulties:

Mechanization, controlled by man-made intelligence, carries unrivaled productivity to monetary warning administrations. Quick information handling and investigation empower quick portfolio changes in view of market patterns. Nonetheless, the test lies in finding some kind of harmony that forestalls over-dependence on robotization, guaranteeing that the human touch and nuanced direction are not eclipsed.

Personalization in Monetary Warning:

The embodiment of compelling monetary warning lies in its personalization. Each financial backer has special objectives, risk resilience, and monetary conditions. Simulated intelligence assumes a urgent part in customizing exhortation by dissecting individual monetary information, inclinations, and economic situations. The test here is to guarantee that personalization isn’t forfeited in that frame of mind of productivity through mechanization.

Advancing Venture Techniques:

Man-made intelligence succeeds in information examination, empowering the ID of examples and patterns that might evade human investigation. By utilizing AI calculations, monetary counselors can enhance venture procedures, adjusting portfolios to individual financial backer objectives and market elements. Finding some kind of harmony guarantees that customized speculation systems benefit from the productivity gains presented by computer based intelligence.

Risk The executives and Consistence:

Man-made intelligence contributes altogether to upgrading risk the board and guaranteeing consistence with administrative norms. Robotized calculations can quickly evaluate risk levels and change portfolios in like manner. In any case, keeping an equilibrium is vital to forestall a simply decide based approach that might disregard the specific circumstance and developing economic situations.

Human Component in Warning Administrations:

While man-made intelligence brings irrefutable benefits, the human component stays indispensable in monetary warning. The capacity to appreciate people on a profound level, instinctive direction, and the capacity to comprehend the more extensive setting are credits that computer based intelligence needs. Finding some kind of harmony includes incorporating computer based intelligence into the warning system while saving the job of human counsels who bring sympathy, understanding, and a comprehensive viewpoint to client communications.

Guaranteeing Straightforward Correspondence:

Compelling correspondence is critical in monetary warning. Finding some kind of harmony among robotization and personalization includes guaranteeing straightforward correspondence with clients. Guides should plainly express the way in which artificial intelligence is used, underscoring its job as a device to upgrade proficiency and give more educated exhortation customized to individual requirements.

Table 1: Performance of AI-Optimized Investment Strategies

| Year | Average Annual Return (%) | Standard Deviation (%) | Sharpe Ratio |

|---|---|---|---|

| 2018 | 10.5 | 8.2 | 1.25 |

| 2019 | 15.2 | 6.5 | 1.85 |

| 2020 | 8.7 | 10.1 | 0.95 |

| 2021 | 12.3 | 7.8 | 1.55 |

Robotization’s Effectiveness and Difficulties:

Dig into the effectiveness got via mechanization monetary warning, inspecting the quick information handling capacities and the difficulties related with finding some kind of harmony. Comprehend how over-dependence on robotization can eclipse the requirement for human info and nuanced navigation.

Personalization in Monetary Warning:

Investigate the urgent part of personalization in monetary exhortation and how artificial intelligence adds to fitting proposals in view of individual financial backer objectives, risk resistance, and monetary conditions. Feature the test of safeguarding personalization despite expanding computerization.

Improving Venture Procedures with simulated intelligence:

Examine how artificial intelligence advances speculation systems through AI calculations. Comprehend how artificial intelligence breaks down authentic information and market patterns to make portfolios lined up with individual financial backer inclinations and targets.

Table 2: Investor Profile and Personalized Recommendations

| Investor | Risk Tolerance | Investment Horizon | Preferred Asset Class | AI-Recommended Portfolio Allocation |

|---|---|---|---|---|

| Investor A | Moderate | Long-term | Equities & Bonds | 60% Equities, 40% Bonds |

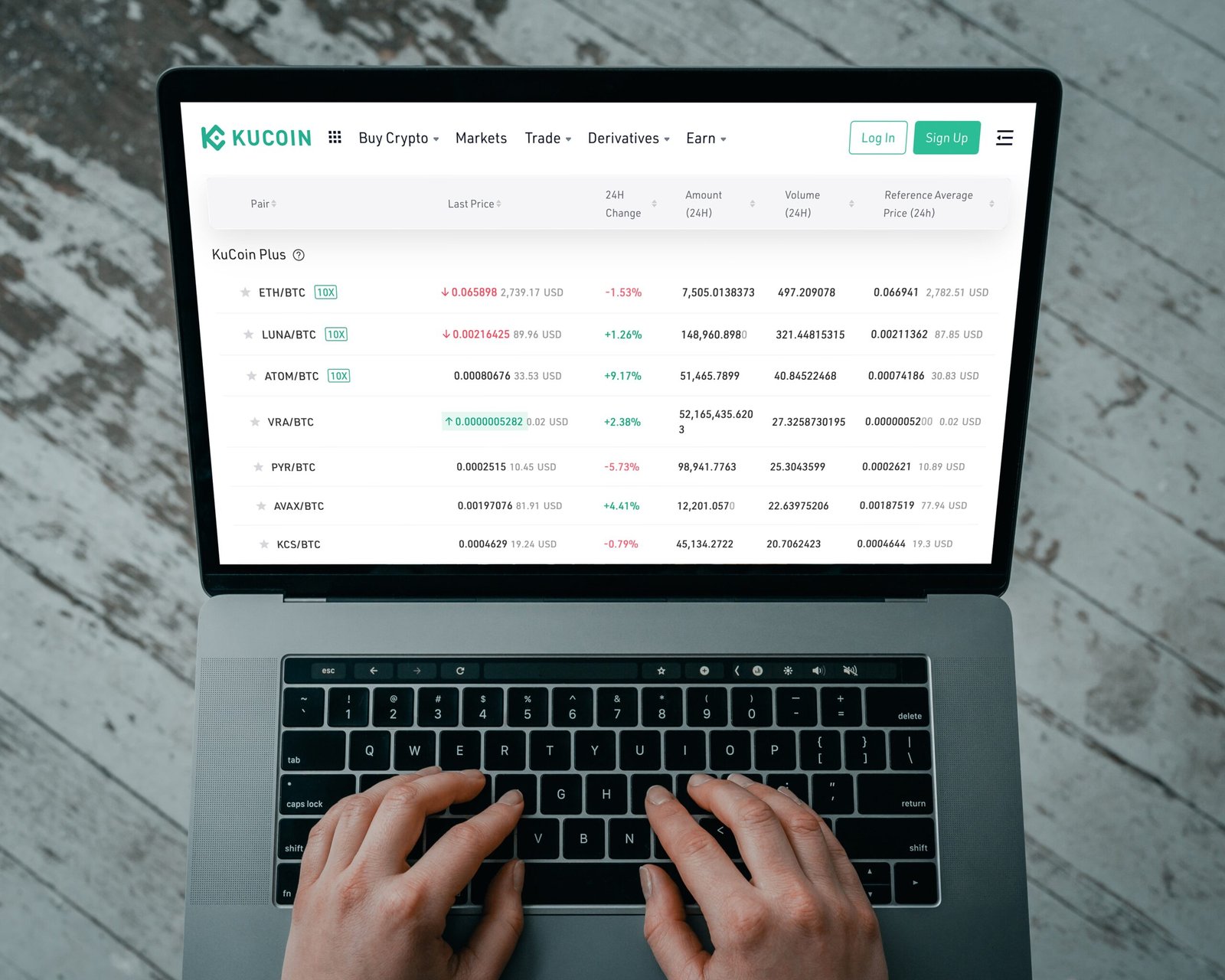

| Investor B | Aggressive | Short-term | Cryptocurrencies | 80% Cryptocurrencies, 20% Cash |

| Investor C | Conservative | Medium-term | Real Estate & Gold | 70% Real Estate, 30% Gold |

| Investor D | Balanced | Long-term | Diversified Portfolio | 50% Equities, 30% Bonds, 10% Cryptocurrencies, 10% Real Estate |

The Future Scene:

Accomplishing Congruity in computer based intelligence Reconciliation:

Looking forward, the eventual fate of monetary warning will probably observe a more profound mix of simulated intelligence. Accomplishing concordance in this coordination includes ceaseless refinement of calculations, tending to predispositions, and refining personalization models. The human-guide organization will keep on being critical, with man-made intelligence going about as a steady instrument instead of a substitution.

The Ascent of man-made intelligence in Monetary Warning:

As innovation keeps on reclassifying the monetary scene, investigate how Computerized reasoning (artificial intelligence) is turning into an extraordinary power in monetary warning administrations. Comprehend the job of Robo-guides and man-made intelligence driven calculations in computerizing errands like portfolio the executives and chance evaluation. Look at the indispensable human component in monetary warning, stressing the capacity to appreciate anyone on a deeper level, natural direction, and the capacity to grasp the more extensive setting. Examine the significance of keeping a harmony between mechanized cycles and human skill.

Conclusion:

All in all, the mix of simulated intelligence in monetary warning administrations addresses an essential second in the business’ development. The fragile harmony among robotization and personalization is the way to opening the maximum capacity of this innovation. As the monetary warning scene keeps on developing, finding the right balance guarantees that financial backers benefit from the productivity gains presented by man-made intelligence while getting guidance that is nuanced, customized, and lined up with their interesting monetary goals.